What is

Credit Card Debt?

Credit card debt is an unfortunate situation that

occurs when an individual over-extends themselves by purchasing goods with

credit beyond their means to pay the debt. In essence, credit card debt occurs

when an individual’s debt, as a result of their credit card use, exceeds their

ability to pay the debt or their income.

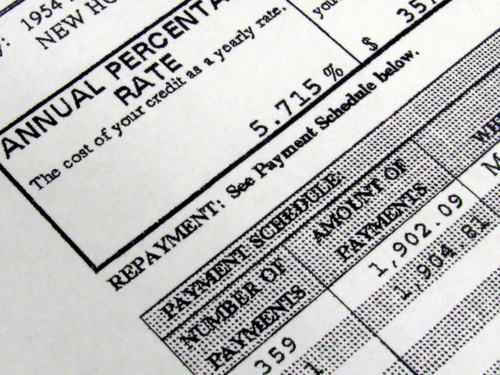

Credit card

debt is fairly easy to get involved with, even if the consumer maintains some

sort of budget. The reasoning behind this prevalence is that financial

institutions who issue credit cards do so with interest or APR rates attached.

These rates are multiplied into unpaid monthly balances. Over time, these small

percentage increases can suffocate a borrower.

Why do most people get in Credit Card Debt?

In addition to interest rates, all credit cards

are attached with finance fees, usage fees and other terms that may be hidden

in the original credit card agreement. That being said, credit card debt occurs

most frequently when an individual becomes reckless with their lines of credit.

The majority

of consumers with credit card debt, when given the ability to purchase a product

in good faith, do not acknowledge the long-term problems that could arise from

an over-extension. Those stricken with credit card debt purchase goods with the

assumption that they will pay them off in the future.

Unfortunately, unforeseen

events occur, such as layoffs or other costs, which prevent an individual from

making significant credit payments. As a result, the consumer is only able to

make minimum payments, which is attached with interest charges.

Example of how APR affects my Credit Card payments

If a consumer has a credit card with an available

credit line of $500 and an annual percent rate of 20% and spends the full

credit amount of $500 in one month on various goods and services, he or she

will be required to pay off that debt over time. Credit card billing cycles are

monthly, meaning the individual is required to pay off all or some of the debt

at the end of each month.

If the individual does not pay the $500 and only pays

the minimum (typically $15), the APR of 20% will be applied to the next month’s

bill in the form of a monthly fee (.20/12), or .01667. Add 1 to this figure to

reveal 1.016, which is then multiplied by your remaining balance. Therefore, if

you have $485 due next month, you will take $485 and multiply it by 1.016 to

yield a new balance of $492.76. This added $7.76 may not seem like much, but

over time as more credit is made available and subsequently used, this figure

will grow exponentially.

In addition, if you multiply the $7.76 times 12

(months) you can see that you are paying nearly $100 in interest for a small

credit line. Credit cards with larger lines of credit will obviously have

larger figures.

Therefore, those who extend themselves more, meaning they buy

more goods with credit, will be more susceptible to facing severe credit card

debt. The terms attached to each credit card will vary based on the issuing

institution’s protocol and the credit score of the prospective borrower.

How to avoid or get out of Credit Card Debt

There are numerous ways to get out of credit card

debt, the most basic of which is to develop a budget and only purchase items

that are needed on credit. The development of a budget, in alignment with your

disposable income, will ensure that you do not exceed your ability to repay the

debts.

Aside from this basic step, an individual facing credit card debt can

consolidate their payments by contacting their lender and developing a more

feasible repayment plan.

In addition to personal approaches, an individual

can get out of credit card debt through the inclusion of a credit counseling

agency. These organizations will provide educational resources on how to

properly balance one’s debt. A credit counseling agency will also work with the

individual’s lenders to create repayment plans that are more feasible.

Aside from incorporating a credit counseling

service, an individual can engage in credit repair by filing for bankruptcy. In

most cases, filing for bankruptcy is a last resort form of credit repair. That

being said, credit card bankruptcy will, in essence, clear an individual’s

credit history after a few years.

As stated before, credit repair is vital for

those individuals facing mounting debts because a poor credit score will

prevent an individual from obtaining any source of financing in the future,

including mortgages, credit cards with favorable terms, personal loans, leases,

and in some cases employment.