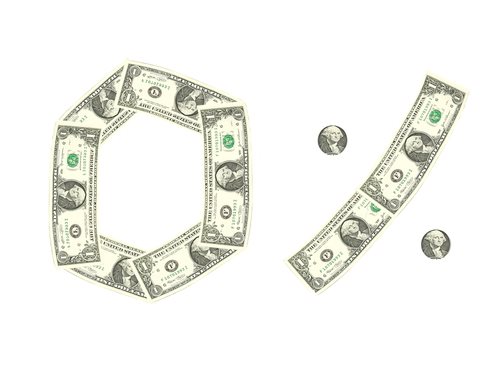

What You Need to Know About 0 Interest Credit Cards

What is Interest in regards to Credit Cards?

Interest rates or APR, are economic variables used to describe the current interest rate of a credit card for a year of use.

The APR is a finance charge expressed as an annual rate and takes the form of two specific definitions: the nominal APR and the effective APR. The nominal APR is the simplified interest rate delivered as a yearly percentage while the effective APR is the compound interest rate, which includes a fixed fee. The nominal APR is calculated as the rate delivered for a payment period multiplied by the number of payment periods in that specific year.

In regards to credit cards, the APR refers to the amount you will pay in interest per year. The APR on a credit card will fluctuate based on a number of factors, the most critical of which is the holder’s credit history. Those individuals with higher credit scores will be awarded with a lower APR.

The lower APR is awarded to an individual with a higher credit score because of the mitigated risk of default—the issuer of the card views the individual as a safe investment and therefore grants the individual with the ability to possess 0 interest credit cards or credit cards with low APRs. The variables that go into the APR or interest rate can yield percentages of upwards to 50%.

What are 0 Interest Credit Cards?

When an individual applies for 0 interest credit cards they are looking to obtain a credit line where the attached annual percentage rate is zero. As a result of the 0% APR, the individual can save a substantial amount over time, even if he or she makes minimum payments.

Those lenders that issue 0 interest credit cards for a fixed timeframe typically do so for the borrower’s first six months to 1 year of use. After this time, the APR is adjusted based on the individual’s credit history and is then attached to the remaining balance (if applicable) of the card.

As a result, those borrowers who obtain 0 interest credit cards must be aware of this alteration in their APR. There is no such thing as long-term 0 interest credit cards; the 0 interest aspect of a credit line is only used to encourage borrowers to open new credit lines.

After a set time, depending on the promotion or the specific deal offered by the lending institution, the 0 interest will be adjusted to reflect a more typical interest cost. That being said, 0 interest credit cards are effective ways to secure a short-term avenue of financing.

Just be cognizant of the fact that the APR will change after an allotted time; running up a severe debt through the delivery of strictly minimum payments could result in huge finance or interest charges was the 0 interest portion is altered.