The Importance of Credit Scores

What is a Credit Card?

What is a Credit Card?

A credit card is an alternative payment method to

cash, which enables a consumer to purchase goods or services on credit. Credit

cards are issued by financial institutions to those individuals who they deem

as fit or credit-worthy. The ability to obtain a credit card and the subsequent

rates or fees attached to the issuance is based primarily on an individual’s

credit history and score.

The interest rates and fees attached to the

issuance are dependent on the individual’s expected ability to repay their

borrowed funds. When an individual purchases goods on a credit card they are

required to reimburse the issuing company the amount spent. If the full balance

is not paid each month the interest is applied and carried over to the

following billing period.

How does Retail Credit Card Processing Work?

When an individual purchases a good or service

from a retail store with a credit card, they simply slide the card into a

machine. Each credit card is equipped with a magnetic strip on the back. When

sliding a credit card through the machine, the magnetic strip will relay the cardholder’s

information to the retail outlet’s point-of-sale system. This step of credit

card processing enables the cashier to integrate the individual’s information

into their transaction.

In addition to using a machine to initiate the

credit card processing through the magnetic strip, an employee at the retailer

can also type the card information (the credit card number on the front of the

card) into their point-of-sale system. This form of credit card processing is

utilized for online purchases or for those transactions that do not involve a

card reader.

All retailers that initiate credit card processing

must sign up for a service that is linked with a merchant provider. Seller

transaction credit card processing systems send captured credit card data,

along with the data linked to the transaction, directly to the merchant account

provider.

Network Interchange involved in Credit Card

Processing

The merchant account must first route the

information through the network interchange to the holder’s institution. The

institution then checks the card’s balance against the transaction amount and

either authorizes or denies the payment.

Once the authorization for approval or denial of

payment has been received, the merchant notifies the seller of the result, who

then will notify the buyer. If the transaction involved in the credit card

processing is authorized, the merchant account provider sends the transaction

information back through the network interchange to the seller, who then

requests the funds to be transferred from the buyer’s credit card provider.

What is a

Credit Card?

A credit card is a plastic card that enables an

individual to purchase goods, products or services by way of a credit line.

Financial institutions, such as credit card companies or banks, will offer

credit cards to those consumers who represent an ability, through their credit

rating, to meet the terms of the credit card contract.

It is

crucial to understand the varying interest rates, or APRs, attached to each

credit card. Generally, those individuals with lower credit ratings, if

approved, will receive a credit card with unfavorable terms and high interest

rates.

A credit card’s rates are applied to the

individual’s balance at the end of each billing cycle. For example, if an

individual is given a credit card with $500 worth of credit and an APR of 20%

and the individual spends throughout the month, or length of the cycle, the

full amount of available credit, he or she is required to pay the lending

institution the full $500.

If the individual does not pay the $500 and only

pays the minimum (typically $15) the APR of 20% will be applied to the next

individual’s bill in the form of a monthly fee (.20/12), or .01667. Add 1 to

this figure to reveal 1.016, which is then multiplied by your remaining

balance. Therefore, if you have $485 due next month, you will take $485 and

multiply it by 1.016 to yield a new balance of $492.76. The terms attached to

each credit card will vary based on the issuing institution’s protocol and the

credit score of the prospective borrower.

Why is Credit Card Protection Important?

All credit cards contain a 16-digit credit card

number. This number, which is found on the front of the card, signifies the

holder’s credit account. It is this information that enables a merchant to view

the amount of available credit to which the individual has access. With the

advent of online purchases, all a user needs in most instances is to input this

16 digit number, the expiration date on the front of the card, as well as the

CV-2 code found on the back of the card to initiate a purchase.

As a result of

the minimum requirements for purchase online, a user can initiate a transaction

by copying or stealing a credit card holder’s information that is printed on

the front and back of their card.

Crucial Steps for Credit Card Protection

Since your credit card account number is printed

on the front of your card, you must be sure to know where your credit card is

at all times. If you happen to lose your card or it is stolen, a crucial step

to credit card protection requires you to immediately contact your issuing

institution to inform them of the missing card.

When the bank records that the

card is not in your possession it will close the count rendering the lost card

inactive. The issuing company will then mail you a replacement. The most common

mechanism for fraudulent credit card use is the unauthorized use acquired from

lost or stolen cards.

Another important step of credit card protection

is signing the authorization strip located on the bank of the card. By signing

your unique signature, merchants can compare the signature on the receipt (at

the time of purchase) to the back of the card to ensure that the purchasing

party is indeed the cardholder.

Another crucial element to credit card protection

requires the holder to thoroughly review all bills and expenses. Make sure that

your purchases match up with your bill. If any fraudulent activity or

inaccuracies are found on your bill, be sure to report them to your issuing

credit card company.

What is

Credit Counseling?

Credit counseling is a process that incorporates

educational courses to consumers regarding appropriate credit card use. The

purpose of credit counseling organizations is to inform consumers as to how to

avoid credit card debt.

Credit cards offer consumers an expedited

purchasing process. Available credit liens also enable an individual to

purchase items with a lack of immediate financial commitment. That being said,

credit cards, when used irresponsibly, can create immense problems for their

holders.

With that in

mind, the primary goal of credit counseling courses or organizations is to

establish an effective debt management plan and budget. The creation of a

conservative and long-term budget will enable an individual to properly extend

themselves in regards to their debt to credit ratio.

Process of Credit Counseling

Credit counseling involves a negotiation process

with creditors in order to establish the previously-mentioned debt management

plan. An effective debt management plan will help the borrower repay his or her

amount owed through the establishment of a repayment plan with their underlying

creditor.

A debt

management plan is established by credit counselors to offer the borrower

reduced payments, interest rates and fees that were originally placed in their

credit card agreement. All credit counseling organizations refer to these terms

dictated by the underlying creditor to determine interest reductions and

payments offered to the consumers in a debt management plan.

Should I hire a Credit Counseling Agency?

A consumer credit counseling service will attempt

to make debt manageable for a consumer, while ultimately keeping these

individuals out of bankruptcy. Consumer credit counseling services operate

under tight regulations due to past discrepancies, where such agencies further

crippled consumers as a result of hefty service fees.

That being said, if you

or a loved one is facing mounting debts, it is recommended that you seek a

credit counseling service to renegotiate your payment obligations with your

respective lenders to lower your monthly rates through consolidation and to

offer information and knowledge to prevent a similar situation from occurring

in the future.

A credit counseling service will enable the

individual in debt to avoid bankruptcy and to diminish their debts. The credit

counseling industry will achieve these goals without the constant harassment of

creditors demanding repayment. When a debtor agrees to operate under the terms

of a credit counseling service they contact the agent or representative of the

credit counseling service and not the individual in debt.

Types of Credit Counseling Services

A number of practices or educational services can

be grouped within the broad field of credit counseling. However, the actual

organizations which promote and establish debt management plans will operate

under a non-profit or profit-based business model. These organizations

typically have existing relationships with credit card companies or financial

lenders.

The benefit of operating with a not-for-profit

credit counseling service is found in decreased fees and the fact that

creditors are more willing to offer lower interest rates through a non-profit

intermediary. This characteristic will, of course, fluctuate on a case-by-case

basis, but is essential to evaluate consumer credit agencies based on the fees

and rates they charge. It is highly recommended that you look for a consumer

credit agency that possesses an excellent rating with the Better Business

Bureau.

What is a

Credit Rating?

A credit rating is a statistical analysis of an

individual’s credit history. The credit rating is delivered as a number based

on the individuals debt vs. credit amount.

This number is used by numerous

lenders (organizations that distribute loans or credit card companies) to

determine whether or not they will issue an individual or business a line of

credit. In essence, the credit rating is the fundamental statistic used to

evaluate an individual or entity’s credit-worthiness.

There are three agencies that will issue a credit

rating: TransUnion, Experian and Equifax. The majority of lenders will evaluate

the credit rating of two of the three agencies. The credit rating is

distributed in a report, which will detail the prospective borrower’s credit

history.

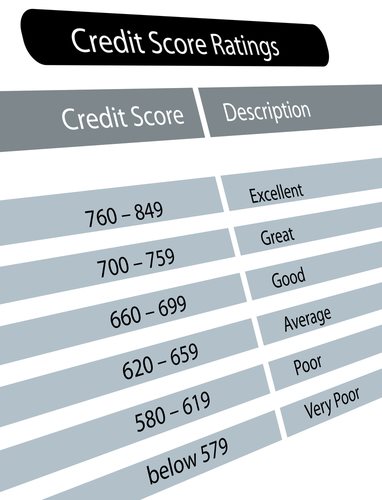

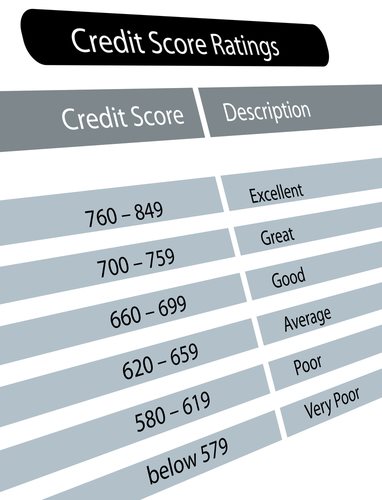

The formula used to determine a credit rating is

known as FICO. Named after the Fair Isaac Credit Organization (the first

company to use credit ratings), this formula will yield a number ranging from

300 to 900 (the three rating agencies will have different scales.) The lower

the credit rating, the greater the risk of default.

An

individual with a score that is below 500 is viewed as a risky borrower to most

lenders. The risk in this sense is tied into the borrower’s ability to repay

the loan or pay off his or her credit card. The credit rating, thus, acts as a

gauge to determine a risk of default. Ratings closer to 300 are viewed as

extremely risky, while those above 800 are viewed as possessing limited to no

risk.

The FICO Calculation used for Credit Ratings

The FICO score is calculated based on the

percentage of an individual’s total credit that is currently being utilized,

the amount of time an individual has had an open line of credit, the types of

credit lines the individual possesses, the amount of past lines of credit the

individual has had, and the number of delinquent payments the individual has on

his or her record.

Each variable in the FICO calculation contains the

following percentage weight to determine one’s credit rating: Amount of credit

currently utilized (30%), the period of time the lines of credit have been open

(15%), the types of credit lines open (10%), the size of past lines of credit

(10%), and the number of delinquent payments (35%).

In a general sense, a credit rating around 500 is

viewed as high risk. This score will generally yield a refusal to lend. If an

individual obtains a credit line with a credit rating around 500, they will be

given a line of credit with higher interest rates, increased fees and

complicated terms.

In contrast,

a credit rating of 800 or above will grant an individual the lowest possible

interest rates, small down payments (where applicable) and limited fees. A credit

rating of around 650 is viewed as safe enough to receive favorable terms. This

score will typically be good enough to receive a new line of credit.

How do I view my Credit Rating?

The majority of organizations offer online access

to your credit rating. These websites will offer reports from the leading

credit agencies and detail why your score may be low. Given the importance of

favorable terms and interest rates, it is recommended that you view your credit

rating to ensure that no mistakes have been made.

Oftentimes an individual’s credit

rating will be lowered because of a forgotten debt or miscalculated payment. In

order to raise one’s credit rating, they must realize the position they are in.

As a result of this, paying a small fee to view your credit rating is well

worth it.

On November 27, 2012, the US Attorney’s office for the District of Montana announced that Devries was sentenced to 110 months in prison and ordered to pay $3,811,221.52 in restitution. She was sentenced for her role in a large bank fraud and embezzlement scheme, credit card fraud scheme, and money laundering scheme.

Devries was the former vice president of operations for First Security Bank (FSB) in Malta. All FSB deposits are federally insured.

According to court documents, Devries had a total of $40,000 in credit card debt by January 2001. She was able to maintain such a large amount of debt because she transferred the balances to new credit cards.

She was eventually declined by a credit card company in January of 2001. However, with her position at FSB, Devries was able to approve a “high limit” of credit debt. After the credit card company declined, she opened a credit card account with FSB on January 4, 2001. The account was opened in the name of RI Inc with a limit of $900,000.

After she opened the first account without detection, she opened a second fraudulent account under the name ADRD on September 14, 2001. She proceeded to open two more accounts on May 7, 2009 and June 2, 2011 under the names of ADCDED and ABC123.

By the time the embezzlement was discovered in May of 2012 the four accounts had balances of $1,100,243, $1,087,562, $1,180,329, and $304,493. Devries was able to avoid detection at FSB using a variety of methods, but she was caught after Fidelity National Information Systems (NIS) reported suspicious activity to FSB in three of the accounts.

Devries charged a total of $3,672,627 to the four accounts.

U.S. Attorney Michael W. Cotter stated: “The future of First Security Bank is uncertain, but Devries’ crimes have caused a grievous financial wound. When a community bank is forced out of business because of external economic forces or internal corruption, it is a sad day for our rural way of life.”

Source: Federal Bureau of Investigation