Merchant Services Lawyer

Merchant Services Lawyer

The need for merchant services lawyers has increased dramatically with the growth of consumer credit cards and ecommerce arrangements. Merchant services process payments made to the merchant and facilitate the payment of the merchant. In serving as the medium between the parties, fraud by the merchant services processing payment can cause significant damages to the merchant, both in terms of reputation as well as operating costs. In the event of extraordinarily high service fees or withholding of payments to the merchant, merchant services lawyers can assist merchants in seeking damages against fraudulent or exploitive merchant services companies.

In what ways can merchant services companies defraud clients?

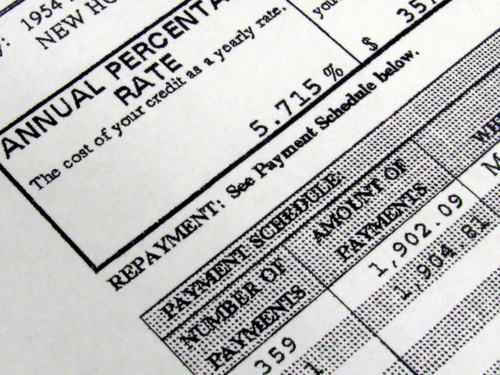

If the merchant services company begins to charge nonconsensual fees or misuses your personal information, you will be able to recover those fees as damages. The worst merchant services companies involve other third parties that charge their own fees. Small businesses that have developed relationships with merchant services companies to accept credit cards at their establishment, only to be defrauded through breach of contract can use the merchant service lawyer to force the merchant services to cancel its fees and repay the client the money withdrawn through misuse of personal information or exploitive billing. Misuse of personal information can be as severe as forging the signature of clients or taking money from the client’s bank account without notice. These violations may include a criminal component, if the merchant services company can be brought into an American courtroom. Application fraud is the use of personal information to open up an account. Some fraudulent merchant services will also do this for the purposes of billing, usually without the knowledge of the client.

Preparing to meet with the lawyer

When meeting with a merchant services lawyer, bring all agreements, electronic or otherwise, made with the merchant service companies. Breach of these agreements is the easiest way to win damages against these companies. These breaches may include raising fees above the agreement threshold without proper notice, processing payments slowly or failing to pay the business the money owed to them in its entirety.

What are issues that the merchant services lawyer may have to deal with?

Many of the most exploitive merchant services are located offshore, beyond the reach of US jurisdiction and regulations. As a result, the merchant services lawyer may have a difficult time of finding whom to file damages against and brining the violators to court. In these cases, the lawyer may file a petition with the Federal Trade Commission to take action against the violator and prevent them from doing further business in the United States. The merchant services lawyer is your best chance at understanding your legal options in the event of merchant services fraud.

What are indications of fraud?

Fraud is usually easy to detect as long as the client constantly checks statements and billing from the merchant services company. Be aware of confusing or vague fees and account for all of the money owned by the merchant services. In case of discrepancies, contact the merchant services for resolution and failing that, contact a merchant services lawyer to files suit.