Many of us have become familiar with the all too common “help” of a retail store employee informing us that we can save 15% on our purchase if we sign up with the store’s credit card. However, while they may provide savings, many find that the percentage they save now may come at the expense of damaged credit and inflated rates later.

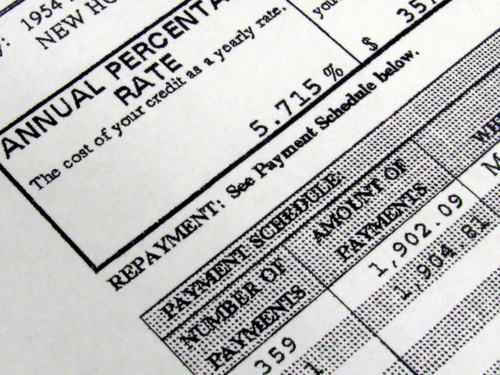

Store credit cards are very similar to standard issued Visa or Discover cards, except that they are often attached with special offers and the promises of future discounts and rewards. However, they also come with the same risks, as interest rates are often very large and spending limits tempting.

Younger consumers, who may not understand the implications of credit card debt, are at risk of damaging their credit and becoming indebted for purchases that seem like a bargain. Most, if not all financial experts, advise that younger consumers should stay away from such credit cards and focus on building their credit in much less riskier methods.