What are new credit card rules?

The Credit Card Act of 2009 provided much needed reform to consumer credit cards which had subjected cardholders to unreasonable fees, soaring interest rates and arbitrary rules. These rules took effect on February 22, 2010.

Reforms to rates, terms and fees

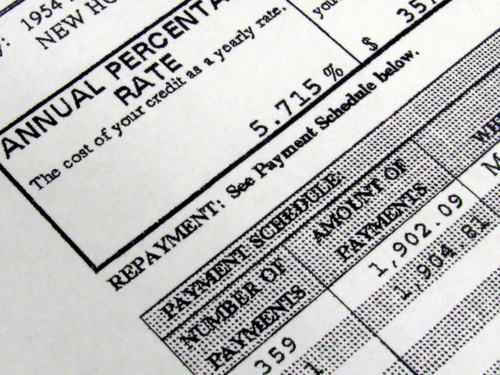

Minimum payments – credit card companies must display on their bill how long it will take for the consumer to pay off the balance is only the minimum payment is made every month. Whenever the consumer pays more than the minimum balance, the leftover amount will go towards paying the next balance with the highest interest.

Billing cycles – credit card companies may no longer charge retroactive fees for the previous billing cycle if there is not a valid reason such as disputed purchases or payments for insufficient funds.

Due dates – the new credit card rules dictate that the due date for monthly payments must be consistent every month and if the date falls on a holiday or weekend, the payment is due on the next business day, without penalty.

Change of Address – a credit card company changes its mailing address which in turn, leads to delays in processing cardholder’s payments, the card company may not charge late fees for sixty days after the change.

Interest rates – the new credit card rules ban retroactive interest rate hikes, with some exceptions.

– An expressed introductory period ends; the law now requires this period to be at least six months.

– The interest rate is variable.

– The cardholder fails to comply with a debt consolidation plan.

– The cardholder misses a payment for 60 days, even then, the rate must return to normal after the cardholder makes six months of on-time payments.

– A military service member leaves active duty which no longer entitles the cardholder to a government mandated cap of 6% APR.

Most importantly, a credit card company cannot raise rates if the cardholder fails to pay balances on other accounts such as utilities or other credit cards.

“Over-limit fees” – usually a credit card is declined when it exceeds its limit. Over-limit fees cover the balance, often with substantial fees. The new credit card law lets consumers opt out of over-limit fees and ensures it can only be charged once per billing cycle. The law also requires those than opt into the fees understand the amount to be charged and retain the right to opt out at any time.

Paying balances – the credit card company is now required by law to not charge additional fees for any methods of payment, unless it is an expedited service to avoid late fees. Statements must now be mailed to the cardholder at least 21 days in advance. Fees may not be applied until 21 days after any declared “grace period” has ended.

Subprime cards

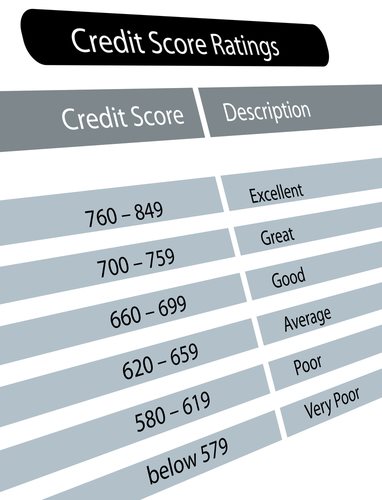

Subprime cards have been known as “fee harvesters” as the holders typically incur several unforeseen fees which especially victimize individuals with poor credit worthiness. Credit card companies can no longer charge upfront fees that exceed 25% of the credit limit.

Reforms to gift cards

The new credit card laws also contain provisions for gift and prepaid cards as well as gift certificates. Unless the issuer specifically discloses it, these items cannot expire within five years. Dormancy, inactivity and service fees are all expressly banned unless it is expressly disclosed and the inactivity exceeds one year. In this case, only one fee may occur per month.

Youth credit reform

Issuing credit cards to persons under 21 is now banned unless there is an adult co-signer. Alternatively, they may show proof that they have the means to pay back the balance. Credit card companies may no longer solicit persons under 21 with prescreened credit card offers.

Colleges and universities must disclose all marketing and promotional relationships with credit card companies including contracts that disclose student and alumni information to credit card companies. These disclosures are subject to inspection by the federal government.

The new credit card laws mandate that credit and debt management courses become part of new student orientation at colleges. Free offers may not accompany credit card promotions at or near (within 1,000 feet of) college campuses. Colleges and universities are now required to limit the number and locations of credit card marketing events.

Disclosures

The new credit cards laws ensure that all fees, penalties and terms are disclosed and that there is at least 45 days notice of changes to credit card agreements. They must also inform the cardholder of how long it will take to pay off their balance when making only the minimum monthly payment. The Federal Reserve must collect electronic copies of all credit card agreements for public record. The Federal Reserve also issues guidelines for card issuers to set up toll-free credit counseling and debt management assistance.

Credit reports

Consumers are entitled to one free credit report a year at AnnualCreditReport.com. Other companies that offer free credit reports must disclose both visually and audibly that their credit report is not the “free one” provided by federal law.

Opting out

The right of consumers to opt out of significant change to their account is affirmed by the new credit card law and prevents opting out to be at the discretion of the card company. Card companies that have account holder close accounts due to radical changes may collect the remaining balance over the next five years, charge a minimum payment amount that is up to twice the percentage charged before the change in terms or hold the former account holder to the same terms of the original agreement.

Consumers cannot be punished for opting out of rate increases. However, consumers are not allowed to opt out of minimum balance increases. Consumers who are more than 60 days late on payments are also not allowed to opt out of rate increases